General election periods have always been interesting. You see all sorts of slander/counter-slander, suing/counter-suing and of course, candies and sweets; goodies and promises flying around on all sorts of media. . One of such promise recently made by the Opposition party related to the automotive sector is the campaign to reduce the price of vehicles sold in Malaysia.

While it sounds like a noble idea, what are the implications? On a larger scale, how does it affect the country’s economy, on a medium scale, how about businesses and on a more personal scale, what does it mean to the average Malaysia who may or may not be currently owning a vehicle? Let’s discuss its demerits/merits here (no, this is not a political discussion. Let’s keep it to automotive related only)

Now, if you do not already know, Malaysia is one country where cars, particularly imported models are insanely expensive, no thanks to the National Automotive Policy (NAP) which was put into place to protect national car manufacturers and stem the outflow of cash overseas. Also, coupled with how a select few individuals who have manipulated the Approved Permit (AP) System (explanation on AP can be found HERE) to their advantage, it’s small wonder that many Malaysians have felt that the NAP has failed to benefit the general public.

Just to illustrate an example, a Honda Civic may cost about RM50-60k in the US but we pay double that price here at around RM120k (don’t ask me why a locally assembled model such as the new Civic with more than 60% local content components still costs a whopping double what Americans pay for a similar model; that’s probably another story another time). Volkswagen, a brand known to produce “The People Car” by means of making its models priced within easy affordability is seen as a luxury brand with a Polo costing more than USD31k and a Passat CC would set you back double that amount at USD70k.

The bad

- By torching the excise duties and other automotive related taxes, Malaysia would be losing between RM6 to 8 billion annually.

- If you are a vehicle owner now and wishes to sell your car in a few years time to upgrade to a better model, the second hand value of your vehicle would have suffered a tremendous hit while you paid a higher price at the time of your purchase.

- Second hand car dealers would be deep sh*t since no one wants to buy a 2nd hand vehicle if the new car price is relatively lower and more affordable while at the same time, they have purchased the pre-owned vehicles at a much higher price prior to the change in policy.

- Us, the owners will be having a tougher time selling our cars because selling price will no longer be the same and the trade-in value to 2nd hand car dealers will dip tremendously as the industry takes some time to adjust to the new selling price. So you might have to wait a little longer for that Beemer you’ve always wanted in your garage as you try to sell your aging Toyota Camry 2.5V which, “IF” by the time the policy is in full effect, your 4-airbags/no-VSA sedan has become far less attractive if UMW takes this opportunity to introduce a face-lifted model with all the bells and whistles at a lower purchase price than what you paid earlier.

- Traffic jams will be rampant as we will see more 2 wheelers going 4 wheels (I don’t quite agree with this unless P2 comes up with a model that sells for RM1-3k like a motorcycle) and this, in turn would result in everyone being late for work which means productivity of companies fall & making less profit which then leads to less taxes collected by the government which will then lead to the country going bankrupt and anarchy will happen, crime increases and the End of the World.

The Good

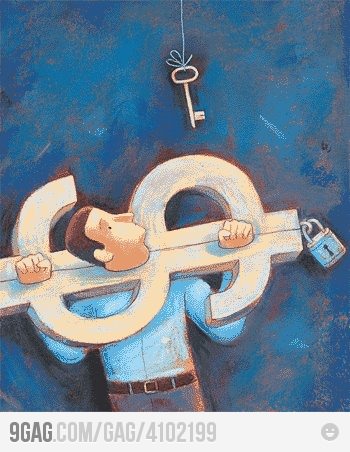

Let’s face it, a significant amount of our income goes to our cars. Banks require a minimum of 1/3 of our income to qualify for a car loan and those earning less may have found some means to over-declare their income with some car loans taking 50% or more of their monthly income. By reducing the price of cars, we can probably expect the following benefits:-

- More income towards purchasing a better home

- More saving for children to pursue better education

- Better standard of living for the family (food, clothing, savings) which means economy is stimulated with more spending

- Increase features and quality of all vehicles, particularly safety aspect as the automotive playing field becomes leveled

- An increase in traffic is unavoidable but I won’t be surprised to see 4 wheelers going 2 wheels as they realise how much more quick and efficient it is for them to travel on a bike. This means those taukeh, politicians, big shots who have to rely on drivers gets stuck more often and complains to the government who tend improves public transportation to get more cars off the streets

How about the loss sustained from purchasing a car full price and selling it at a much lower price if the new car price goes down? Well, you’d be buying a new car at a lower price too so the price difference is somewhat offset. But here’s the problem: when you’re trading in an old car for a new, you worry about 2 things:-

1) Fully settle the outstanding car loan with the bank

2) Fork out a minimum 10% downpayment CASH for the new car

So, here you are, happily thinking that you’ve worked your butt off paying for the car and finally, you’re down to RM40k loan outstanding and last you checked, your 7 year old Camry still fetches around RM60,000. Great, you can still get back RM20k and upgrade to a more decent car that costs around RM200k. Then, the policy came into effect and your Camry’s value suddenly dropped to RM30,000. So if you insist on going ahead with the purchase, you’d need to come up with:

Additional RM10k loan settlement + RM20k downpayment = RM30,000 cash

Sucks, doesn’t it?

The solution? Don’t change cars until your loan is fully or partially settled so that you don’t have to pay the bank anything. It’s not like your current ride is going to die on you immediately … and if it does, well, you’d still need to do what you need to do regardless if there is such a policy or not anyway so the point is moot.

I’m all out for improved public transportation. Despite owning a car, I do commute down to KL in a train or two every once in a while and I see a different side of Malaysians who are kind and peaceful, made up of different race and color. My gripe with the national transportation system is that it’s unpredictable which may cause me to be late for my appointments, making it not a feasible option for my daily job.

I strongly agree that the price of vehicles must come down. A car is a depreciating liability, therefore it seems rather ridiculous that we have to allocate 20-50% of our monthly income to pay for something that costs less with each passing day; those monies can be put to better use and make life more meaningful than on 2-pairs of wheels. But I feel this is not a simple YES/NO answer to the excise duty. There are a lot of vehicles currently on the road. Not only do we have to consider the increased traffic on the road, there are also a lot of Malaysians currently serving a loan tenure with the bank. Dropping the car prices like a pile of hot crap without giving it a period of adjustment may cause further stress on Malaysians who’re deep in debt. There are various other means that can be done to achieve this goal such as gradually reducing the excise duties over a period of a few years. This would mitigate the losses of current owners while every party in the automotive sector have time to adapt to prices that reflect the true value of vehicles.

By the way, I am surprised that there are a lot of Malaysians out there who believe that for this to become real, something else have to go and have suggested to float the price of fuel. IMHO, we are an oil producing country. No one has to pay us anything for us to get the oil from our own soil. The subsidy is in the form of oil companies loss of revenue if (the oil) exported. Floating petrol prices may indeed increase the country’s revenue but it would cause more problems than solving it.

If tomorrow RON95 doubles, your roti bakar & teh tarik may go up 4-fold, taxi, bus & train fare jumps as operation costs increase (or more bus operators decides to fold) …. essentially, the entire logistics of the country would be affected and as long as the average income of the rakyat does not improve, tampering with this may have severe negative repercussions. Before you condemn this thought, consider the nasi lemak makcik/pakcik who rides a motorcycle and fetches their 3-4 children to school while trying to make ends meet. The price of cars go down but they still can’t afford it. Suddenly petrol prices goes up, the cost of riding the bike increases with similar mark-ups at the cost of vegetables and other food materials. How does this help them? Think about it …. how many Malaysians are in the lower income group & earning less than RM3,000 a month with 6 to 8 mouths to feed back home?

So therefore, if it’s revenue the government wants, then I would agree that those who has more than 1 car under their names should either be taxed higher at the point of purchase or a higher road tax be collected from them. If you’re a company with a fleet of cars, the government is happy with more money from you while you’re happy to declare lesser profits on the P&L statement as the cost of business is transferred here. Win-win situation for everyone. Some might say they can buy their 2nd or 3rd car under another name but really, eventually, that boss is gonna run out of mothers, fathers, uncles, aunties who doesn’t drive … other siblings who do drive (or have kids who’re going to drive) won’t be so willing to pass this privilege to another.

So what do you think?

7 Comments

well said

I strongly support the proposal to scrap the NAP. It is true that in the short to mid term, there will be a significant financial impact to the public in the form of sharply depreciating value. The mathematics to calculate the loss on the car does not factor in the available cash flow freed up for other things. As we say, cash is king. You may have taken a loss but the additional available purchasing power in the form of cash not spent on the next car is a powerful stimulant to the overall economy – a lot of people cannot afford the cost of homes today because of the debt caused by our cars.

The scrapping of this policy will also cause significant grief to used car dealers. I am not very clear what happens in this situation to the broader economy but we should consider the implications and cost of “bailing out” or providing relief to this market segment.

I do not agree with the argument regarding the loss of revenue equivalent to 6 – 8 billion MYR. The solution is simple – stop wasting my money!! Stop the nonsense SMS’, give me transparent government finances, stop giving election based hand-outs under the guise of social welfare, stop increasing civil servant pay and bonuses for political reasons and stop funneling money to cronies or other graft.

I agree that they can’t just make the change so sudden and a gradual decrease in price would be more proper. But i think our income should be increased instead as you said the car price may go down but others may go up like petrol, what’s good of a car if you can’t afford petrol? so to me the main concern would be the amount of income we make especially we normal working executives and not managers or taukehs.

While I agree that depreciation of existing vehicles will increase, people need to realise that unless you are driving a Toyota or Honda, you will suffer high depreciation no matter what. For example, if you purchased a 408T on a 9yr loan, would you be able to sell your car and gain enough money for a downpayment on a new car within the first 5 years? Thus I find the depreciation concerns to be moot unless you own a brand that has good resale value in the market. This is the main reason why most Malaysians hang on to their cars up to 10yrs or more.

Similar could be said of used car dealers. They are already gaining a huge bargain when they buy your car at a huge depreciation and would suffer minimal impact because the car you sold them was already at its lowest point of depreciation. However, for brands with perceived high resale the scenario will be different and the used car dealer would suffer noticeable profit drops.

Regarding, increased traffic, it is inevitable. Even without lower car prices, the amount of vehicles on our roads will continue to increase because our population is increasing and migration from towns/rural areas to the cities will continue to happen. So this is another moot concern. However, the positive side effect of this would be that families that were riding with up to 4 people on a motorbike will now be able to afford a car. This would increase road safety for them and also allow existing owners to move on to affordable safer cars.

On loss of revenue, the govt should stop looting national funds by spending them on wasteful projects. No amount of revenue is going to be sufficient if they continue to steal the money they’ve collected from the rakyat. Stop such practices and instead practise financial prudence for a change of a better future for all Malaysian.

I doubt there will be a super huge increase from 2 wheelers to 4 wheelers. I have worked frequently in Jakarta and Bangkok, both countries no not have NAP, and yet there any many people who prefer 2 wheelers due to lower running cost and mobility benefits.

If NAP is abolished, there will be a lot of pain points as you have pointed out, and I agree with you on them all. While the hit in revenue is big, our government should work out a way to gain revenue from other areas such as developing the economy more such as k-economy, services etc, rather than just relying on Petronas, resources industry, and labour intensive industries like agriculture and low tech manufacturing. In short, we need to improve the economy. How this gets done? As soon as the government/politicians put aside their differences and get to work improving the country.

IMHO, if base on rafizi’s article, abrupt changes to current pricing would be a bad idea.

Regardless whether this is merely political gimmicks by PKR, my view on this:

1. It is a fact that even P1 & P2 cars are being tax at least 85%, I really prefer this being reduced gradually so that more rakyat can afford to buy cars (or at least buy a viva/myvi/saga/persona/preve/oxora for what it actually worth). For non-national makes, perhaps starting with abolishing the AP.

2. The G (especially current G) really need to manage our beloved Bolehland with integrity, transparency, good governance and efficiency.

3. G expenditures especially mega projects shall go through detailed cost estimates, being challenged, undergo cost risk assessment. Tendering shall undergo screening of bidders, open tendering exercises, thorough techno-comm evaluations. All these need to made know to public including contractor’s performance and progress. Perhaps, costs to improve our public transportation can be scrutinized and optimized via these steps.

3. The current G must be responsible and take immediate action to prevent/minimize Illicit Financial Flows http://iffdec2011.gfintegrity.org/ which the number is very staggering and alarming.

4. The current G must be responsible and take immediate actions to prevent further leakages from fraud/corruption based on recent General Audit Report.

Only with this, the loss of RM8b income per year from car taxes means nothing actually and no problem to maintain the fuel subsidy. Moreover, this temporary loss can be replaced via other means/sectors where rakyat’s quality of living are elevated and have more purchasing power.

Just my seposen.

p/s: Perhaps, the move by PKR would at least trigger something on the Jeeb’s side of the field, even a small and gradual reduction would be much appreciated by us rakyat.

Saya sgt bersetuju dgn cadangan menurunkan harga kereta lebih-lebih lagi kereta buatan tempatan.

Sebagai contoh, bagi yang berpendapatan bersih RM 1000 sebulan (belum kira 2.2 juta rakyat yang bergaji kasar/pokok bawah RM 1000, sumber http://www.bharian.com.my/articles/2_2jutapekerjabergajirendah/Article/):

Viva 660 BX (RM 25312.15, manual, xder radio)

= RM 277.37 sebulan (pinjaman 90%, bunga 3.5%, 9 tahun)

= 28% daripada pendapatan bersih

Andaikan cukai eksais dikurangkan drpd 75% ke 45% + 10% cukai jualan:

Viva 660 BX (RM 21207.48, manual, xder radio)

= RM 232.40 sebulan (pinjaman 90%, bunga 3.5%, 9 tahun)

= 23% daripada pendapatan bersih

Andaikan cukai eksais dikurangkan drpd 75% ke 15% + 10% cukai jualan:

Viva 660 BX (RM 17102.81, manual, xder radio)

= RM 187.41 sebulan (pinjaman 90%, bunga 3.5%, 9 tahun)

= 19% daripada pendapatan bersih

Mereka yang tergolong dalam kategori di atas membeli kereta sudah pasti sbg satu keperluan (menghantar anak-anak ke sklh, pulang ke kpg), jauh sekali utk bermewah2. Sekurang2nya pengurangan cukai eksais dapat mengurangkan beban isi hutang bulanan, yg boleh digunakan untuk keperluan lain, menanmbahbaik kualiti hidup mahupun menyimpan sedikit untuk waktu2 kecemasan.

Bagi yang berfikir harga kereta murah hanya menambah kesesakan, ingatlah x semua rakyat malaysia duduk di bandar2 besar sprt KL, Penang, JB. Sekurang2nya di KL ada pelbagai kemudahan pengangkutan awam sbg pilihan, itupun masih belum efisen dan menyeluruh, menyebabkan ramai yang terpaksa beli/guna kenderaan persendirian.

Selain pengurangan cukai untuk kereta jenis ekonomi/tempatan, harap kurangkan sedikit (cth: cukai eksais 80% kpd 30% + cukai jualan + duti impot) bagi kereta jenis impot sederhana (kurang daripada 2000 cc). Sekurang2nya golongan pertengahan akan mampu memiliki kereta yang lebih berkualiti, secara tidak langsung memberikan cabaran/saingan kpd Proton utk menambahbaik kualiti kereta) yang sudah lebih 20 thn dalam zon selesa.

Cumanya, bg kereta jenis mewah (BMW, Mercedes, Audi) n berkuasa tinggi (Ferrari, Lamborghini, Porsche), dikekalkan pd kadar cukai skrg atau boleh dinaikkan lagi untuk menampung pengurangan cukai kereta jenis ekonomi/tempatan/sederhana. Pastinya, golongan2 elit ini, yang pastinya duit sampai tak tahu nak buat apa, sentiasa mampu dan akan terus membeli kereta mewah/berkuasa tinggi dan demi menunjukkan/menjaga status mereka.

Cuma 10 cents saya