As covered in Part 1 of the 2015 sales review, 2016 WILL be a tough year and in weathering tough times, expenditure would have to be more regulated and the area that would likely see the biggest cut is advertising and promotion. Companies need to do as much, if not more than the year before with less resources.

This is where things get interesting. Looking back at the conclusions we’ve uncovered, let’s put them into perspective.

You could be a roti man on your trusty motorbike making rounds serving the neighborhood or a well paid executive selling nuclear armaments to a third world nation, either way you serve two kinds of people:-

In the center are your Customers. These are folks who have parted money to purchase what you’re selling, be it a product or a service.

Before they’re converted to Customers, they are Potential Customers. At any given time, there are a number of Potential Customers being converted to Customers and random people outside the circle dropping in to be Potential Customers. There are many reasons why people do that. To name some:-

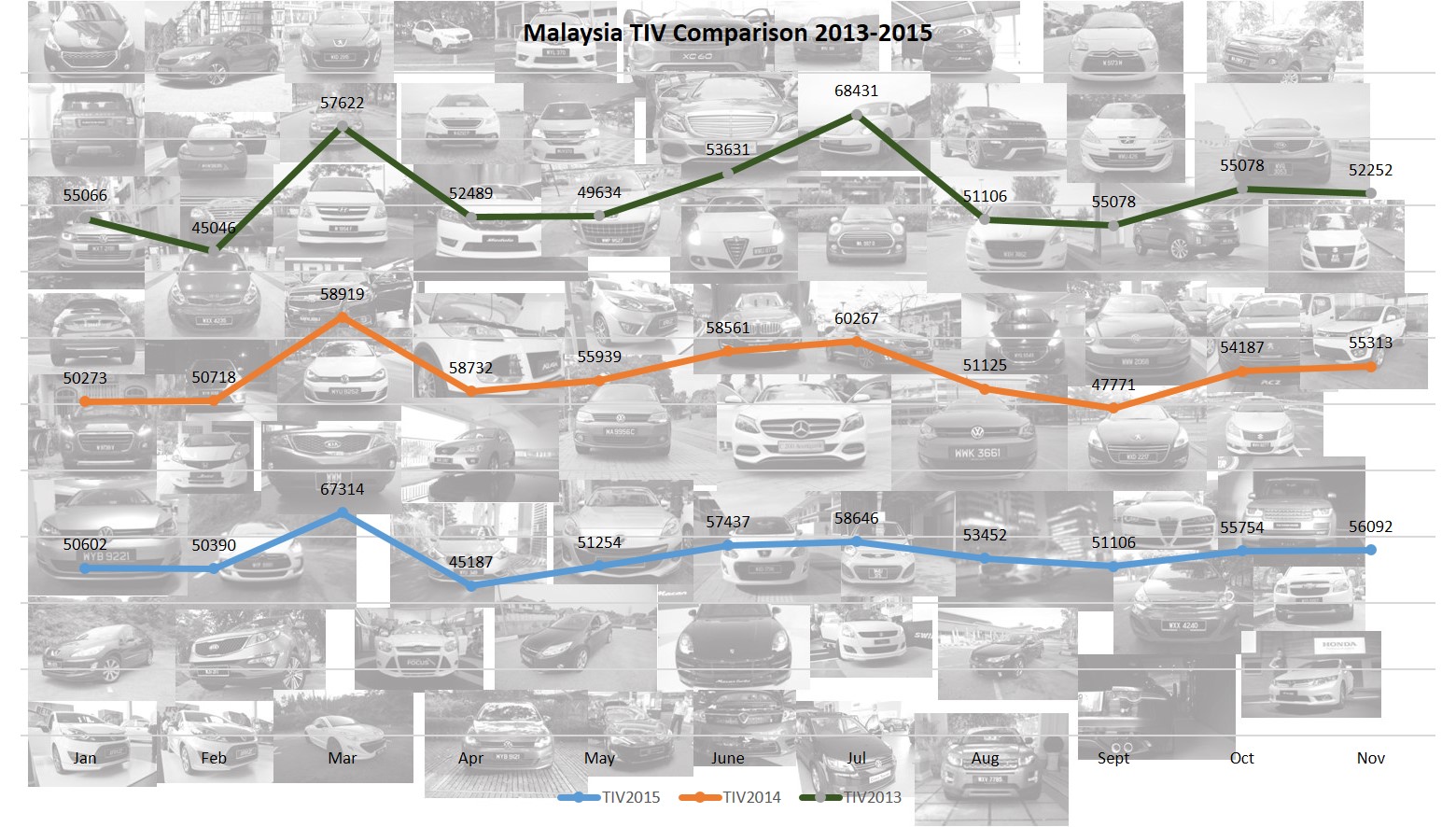

The latest sales statistic provided by Motor Trader Malaysia revealed November 2015 Total Industry Volume (TIV) and here’s how the Year-to-Date compares to the previous two years:-

March has always been the month that records one of the highest number of new vehicle registrations in the year, due to the new year’s batch of vehicles being delivered to customers who does not wish to purchase year end models. March 2015 sees the TIV breaking the 60,000 unit mark due to the imminent implementation of GST on 1st April and everyone rushing to get their cars registered before the perceived price increase.

The increase in TIV means the conversion rate from Potential Customer to Customers has increased. The introduction of GST pushed it further on an otherwise busy month and notice how the number of Potential Customers is now thinner in the infographic above?

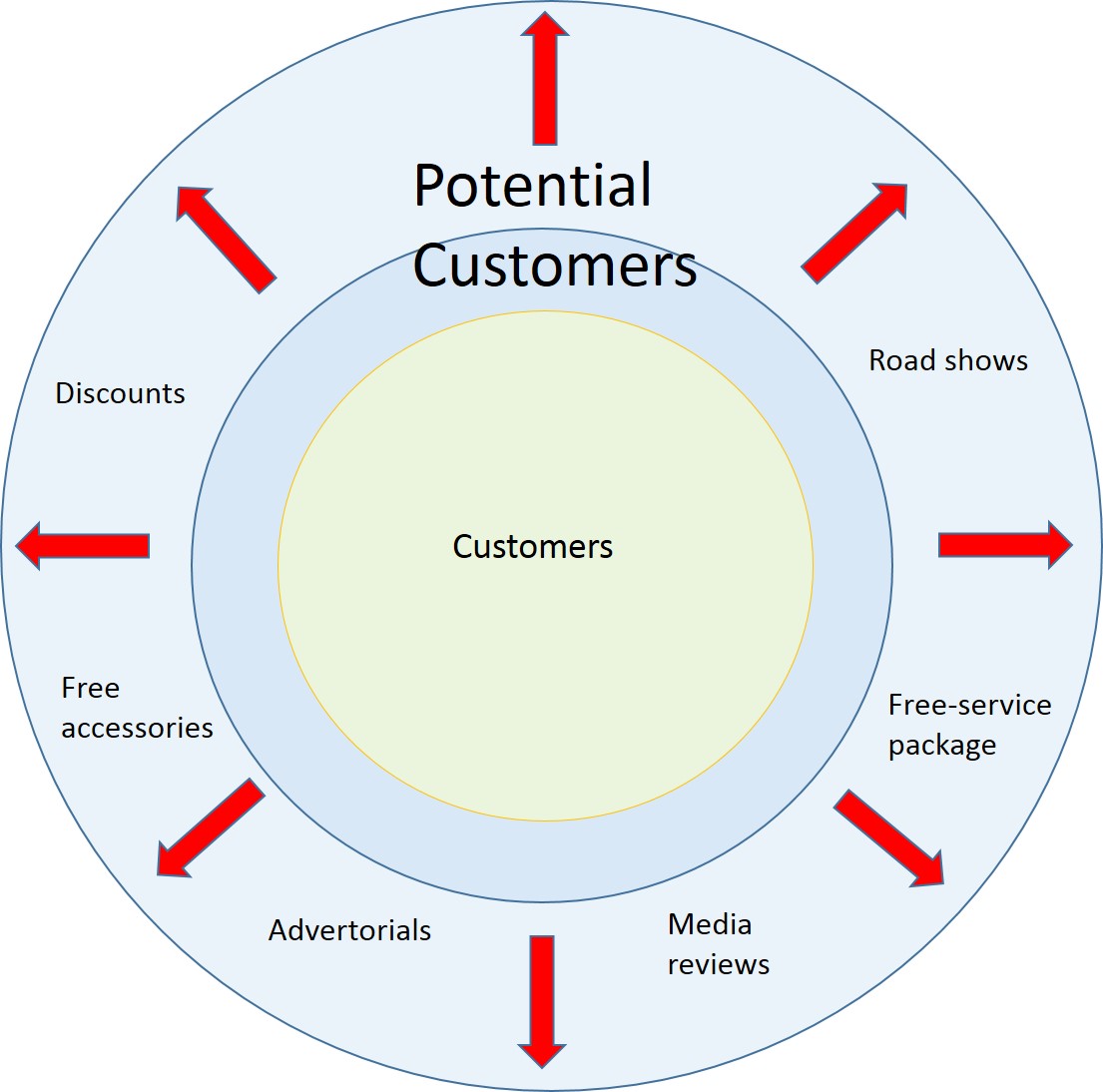

The months that followed saw “winter” where TIV numbers had a sharp decline and is largely due to the market adjusting to GST and the high delivery numbers in March. In short, the spurt we saw at the end of Q1 was not sustainable and companies need time to cultivate more Potential Customers. To do this, companies engage in various activities to increase awareness and interest which then grows the number of Potential Customers. If the environment is fertile, the recovery period is not that long and looking at the graph, TIV figures usually recover in Q2 and we see another spike in July thanks to Hari Raya “go back to your kampung in style” promotions.

Except this year, it was around this period that the Ringgit started its plunge and with GST plaguing us like some flu that won’t go away, small wonder no one is in the mood to shop.

And when the buying stops, you get better deals

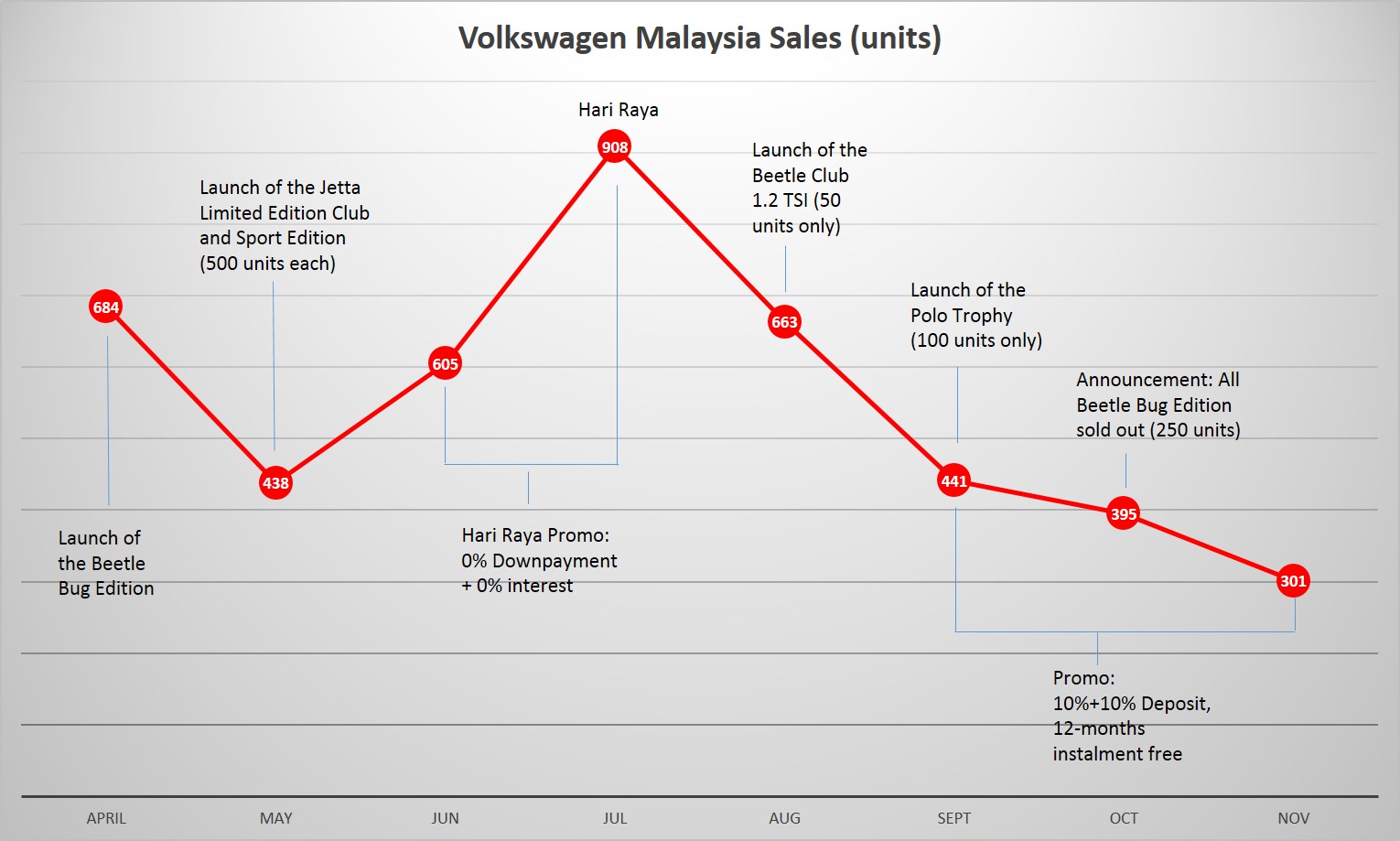

Never before have we seen promotional deals this spectacular. Among all the “baits” that ran last year, few can top Volkswagen Group Malaysia’s (VGM) offer that’s been running since September till end December. You pay 10% deposit, Volkswagen would top up another 10% AND pay 12-months worth of bank installments for you. This means if you purchase a VW Passat today, you save as much as RM40,500, which is almost a 25% discount for a brand new car. You would imagine such a shocking offer would have customers queuing up to buy one of the six models offered under this scheme – except it’s not.

Tracking the sales performance since GST implementation, VGM recorded its highest sales in July during the Hari Raya season. Then, the projected savings of a Passat was RM44,000 which is higher than the current offer. Pity we are unable to see the individual model sales otherwise we would be able to glean better sales insights. VGM would have to think of strategies to sell its 2015 or older stocks (limited edition body kit/decal equipped models, anyone?) yet at the same time manage the currency issue.

And just today, VGM has announced an over trade program where you drive in with your present ride and be entitled for a high trade-in value depending on model. Taking the Passat again as an example, maximum trade-in value (subject to inspection by VW authorised centres which makes the final decision on the price if accepted) is RM42,000 which is higher than the Sept-Dec 2015 offer (RM40.5k savings) but lower than the Raya sale (RM44k savings). The downside is the Passat is a 2014 model so it’s true that they have old inventory and is clearing them as best as possible.

Not necessarily a bad thing because old inventory that usually acts as a buffer for four to six months (or in the case of VGM much longer since they have inventory all the way to 2014), which explains why some manufacturers such as Honda, Lexus, Toyota and some Peugeot models managed to hold off increasing prices till 2016. VGM’s Managing Director Armin Keller recently told The Edge Financial Daily that although there was definitely an impact on the margins for the German auto car maker with the weakening ringgit, it will not be passing the cost on to consumers “for the time being”.

VGM’s decision to walk the “affordability” and “accessibility” road is certainly welcome news for many of us but despite that VGM closed November with its worse performance year to date at 301 units. Sacrificing bottom line profits for sales numbers isn’t new but despite running the 10+10%, 12m offer for the past 3 months and the numbers aren’t improving, this isn’t a problem throwing lots of money at would work. Until and unless VGM improves its customer ownership experience and start winning fans, it’s going to be a tough year.

Consumers today want value. More than that, they perceive service as part of that value. You can be the one cooking the best char koay teow but if you treat customer service as disdainfully as cleaning a blocked toilet, no one is going to patronize. The decline we see in VGM’s performance is due to its inability to regenerate its Potential Customer and subsequently exhausting it towards the final few months of 2015. Having a trade-in program may appeal to those who is unable to apply for two vehicle loans since it takes one away from the customer. Whether this is a bait Potential Customers will bite and bridge the trust deficit the company has remains to be seen.

1 Comment

Spot on! Cars dealership is no longer just a sales business, but it has evolved into service business as well. And in any service business, customer experience is the key ingredient for success. Some of which are willing to pay extra for that extra luxury experience I would say. Hope all car manufactures and dealers realize this and start to make a difference and by right, start seeing their sales booming. So wake up VW, Proton, Ford, Kia, Peugeot and so on!