Yesterday many of us were surprised to hear that Bank Negara Malaysia has seemingly done a U-turn, rescinding its policy that there will be no interest charged in the 6-months bank moratorium. Then the Association of Banks Malaysia (ABM) issued a statement saying banking institutions will provide borrowers with two options at the end of the moratorium:

1) Pay the accumulated 6 months’ deferred installments together with their October 2020 installment without being charged any additional interest; OR

2) Continue the repayment of these installments post-October 2020 through an extension of 6 months in repayment period after the original maturity date. In this case, interest based on the contractual rate will be charged on the amount of the deferred installments that remains outstanding until these installments are fully repaid, which should be by the end of the extended 6-month tenure.

It’s a difficult moment for many of us as paycuts, retrenchments and business closures are common on a daily basis and the last thing we wanted to hear was that the car loan we thought we didn’t have to pay for the next 6-months without penalties ….. well, there are ….. Consequences.

For me, a 20% pay-cut was still manageable since I don’t have to pay for my house and car. But now that I have to start thinking about the RM1,6k a month for the car again, I got agitated.

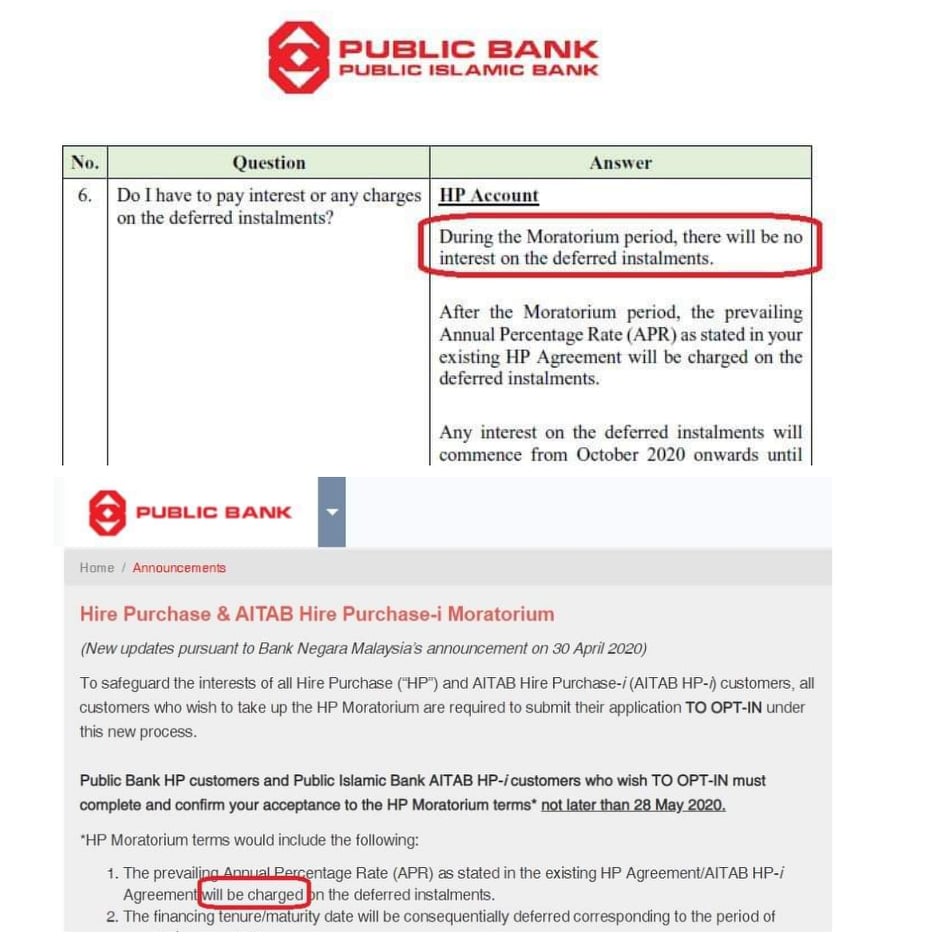

Bank Negara Malaysia says it was a case of misunderstanding. I call bullshit as you can still find contradicting statements in some bank’s FAQs. Above is one such example from Public Bank. In the FAQ, it states that APR will only be charged to deferred payments AFTER the moratorium. But in their main website which is updated with BNM’s 30 April announcement, it says they WILL charge APR on deferred installments.

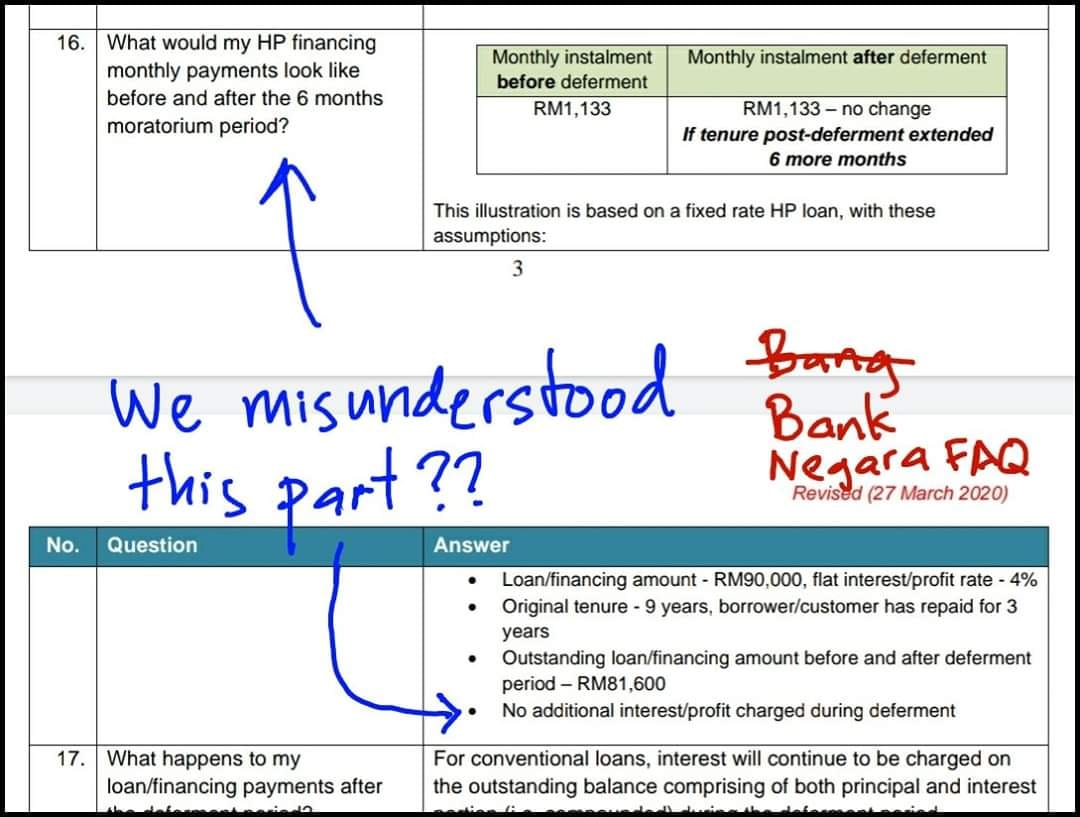

Then we’ve got this viral photo going around alleging that BNM deleted an earlier FAQ, replaced it with a new one and claims it was our fault for misinterpreting their words.

Yeah, right.

So what do we do now?

All this reminded me how little control we have over our debts if we owe someone money. I went around looking to understand how did we get to this stage and came across a viral post by Sam Young on Facebook

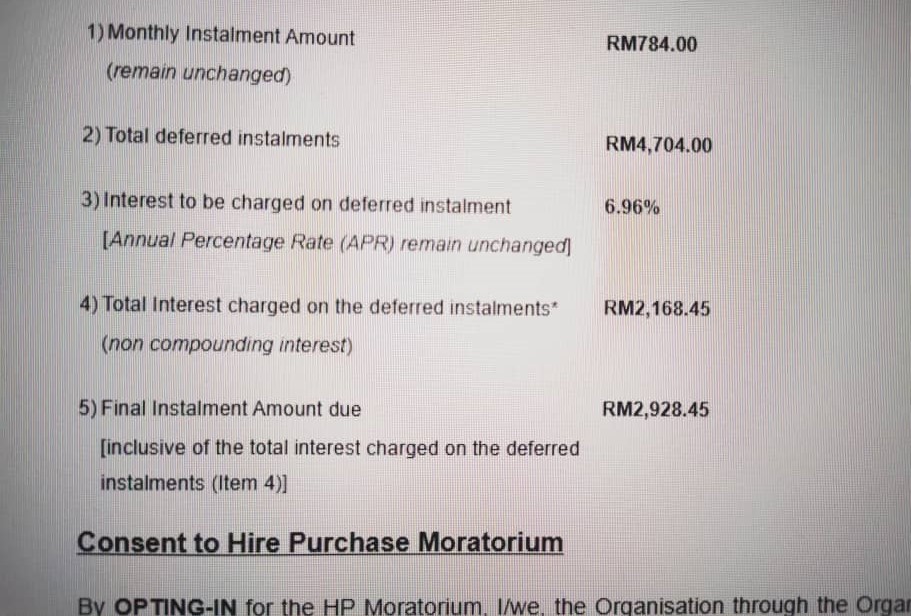

Sam shared that his car loan had an annual interest rate of 3.8% and he still has about 7-years to pay it off.

To suddenly see a weird number like 6.96% and an extra interest of RM2,168 on his statement is quite upsetting to say the least.

Ignoring the fact that banks did a full 180 on us, how did the numbers come about?

Fact 1: Banks say interests will continue to accrue but not compounded

Question: How will my interest/profit charges be calculated during the moratorium period?

Answer: Interest will continue to be accrued on the outstanding balance during the moratorium period.

This question is found in almost all bank FAQs now. The problem is, everyone thought that the accumulated (accrued) interest would just be settled at the extended 6-months at the end of the loan tenure. In other words, if you took a 7-year loan, the interest would be paid off in the last 1/2 year of the extended 7 1/2 years. And if we think about it, it makes sense because the banks will still collect their money’s worth.

They just need more time to collect it.

And time is the unit in which interest is calculated.

In short, the longer it takes for the bank to collect money, the less they make. Someone told me the banks are expected to lose some RM1bil by the end of the moratorium. So I’m not surprised ABM coming up & telling BNM “Bro, we need to talk”

So how does this whole interest thing work?

Imagine this scenario as an example ; if you borrowed a certain sum of money in which every month, you need to pay back RM1,000.

That RM1,000 monthly repayment is made up of 2 parts; RM50 interest + RM950 principal sum

Now if you took the 6-months moratorium, you avoid paying RM6,000 during that period.

But you would have accrued RM50 x 6 = RM300 in interest.

Once the 6-months moratorium is over, How do you resolve this RM300 interest?

ABM only provided two options which is to pay the 6-months deferment + October outstanding in 1 lump sum (this is the most straightforward) or you carry on with your regular repayment schedule and that RM500 interest you acrrued earlier? Well, it gets compounded with another separate interest rate.

Yes, on top of your car loan interest rate, you have another interest rate slapped on top of your existing loan but only if you all that accrued interest to exist.

Think about it this way; if there were no moratorium, there would be outstanding. But with the moratorium, interest is still charged and is accrued

APR is not EIR

I’m sure we’ve all come across advertisements like the one above where they tout a relatively low interest rate number but there’s another number called Effective Interest Rate (EIR) in smaller font size.

When we say car loan interest rate, we refer to the rate as Annual Percentage Rate (APR). It’s something that’s charged upfront, divided over the loan tenure.

This is why there is no change in the repayment schedule for a 5-year loan even though you’ve paid 4-years (80%) of it. It’s the same principal as the advertisement above where the 5.88% is in reality 10.9% when you factor in the cumulative effect.

To take Sam’s example where his bank charged him the on-top-of-existing-loan 6.96%, that’s the bank deciding to apply EIR as a one-time fee on the accrued interest which makes sense since EIR isn’t spread over time. The moment when you paid the interest, the EIR is removed. They can’t use APR because that would mean adding interests on top of that interest then dividing it over a period of time (imagine a micro car loan on top of your main car loan).

So Sam’s post sheds a lot of light on how the banks will calculate the accrued interests (IF you decide NOT to pay the interests.

They will calculate EIR on the interest, multiplied by the period of installment and ask you to pay that accrued AND compounded interest at the final payment

So in Sam’s case, his 3.8% interest rate on his car loan is the same.

If he decides to NOT pay anything extra at the end of the moratorium & continue his RM784 monthly repayment, he will have accumulated an additional RM2,168 by the end of his 7-years loan.

RM2,168 divided by 84 months (7-years) is equivalent to RM25.81 per month extra.

That RM25.81 per month is what the banks are charging him for the facility of ignoring that accrued interest during the 6-months moratorium in the 7-years he has left to settle that interest. And this, my friends is how the bank intends to recoup the losses incurred by “giving” you 6-months delay in your repayments to them.

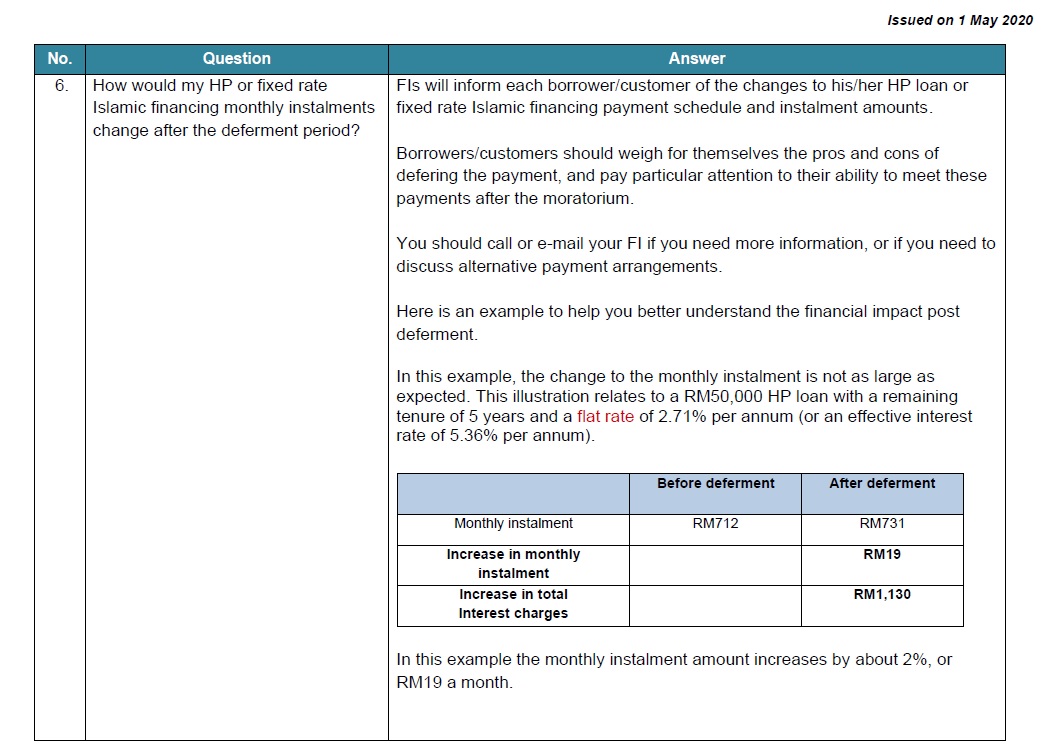

This is consistent with the example Bank Negara Malaysia has issued in their recent FAQ

(Note: In BNM’s example above, how many of you noticed that RM712 x 60-months which is the remaining tenure of 5-years equals RM42,720. Even if we use the revised RM731, the total comes to only RM42,860. Even simple mathematics BNM can get it wrong)

In the example above, replace the 5-years with 7-years, flat rate of 2.71% with 3.8% (or an effective interest rate of 6.96%), you’ll get something like Sam’s case.

What is not clear is if Sam’s bank extended the repayment period by 6-months because of the moratorium.

And it still remains to be seen if other banks will follow the same calculation or they work out something different

Guess we’ll know more these coming days. Please check with your respective banks to verify the numbers as soon as convenient.

Good luck and stay safe!

No Comment