Fancy that Nissan 350Z that will win you endless amount of ONS once the chicks see you cruise down the club? Or that Honda Accord 3.5lire V6 with Variable Cylinder Management which allows the engine to operate on three, four or all six cylinders to help boost fuel economy or power as needed? Or how about the Toyota Land Cruiser 4.7litre with its ultra-comfy suspension?

And now, after years of fantasizing at that full sized dream car wall poster you have in your bedroom, you finally see it! The car! At a price you can finally afford. As a matter of fact, a quick check in Mudah.my, one of the most popular online advertisement sites in Malaysia shows the a 5 year old 350Z being had at the price of a Proton Inspira 2.0. A 4 year old Honda Accord? A measly sum of around RM130k and you think the first owner must be crying for losing almost half the value of the car in that period of time when he/she had it.

But before you proceed, do you really know how much it would cost you year after year when you renew your road tax? And this is something not everyone considers because our tax structure is designed to tax those who’re more financially capable of purchasing such an expensive car and for regular blokes like us where a Spritzer 1.5litre water bottle has a larger cc than our NA engine, such trivialities don’t matter much … until you “think” you can afford a 2nd hand high displacement vehicle.

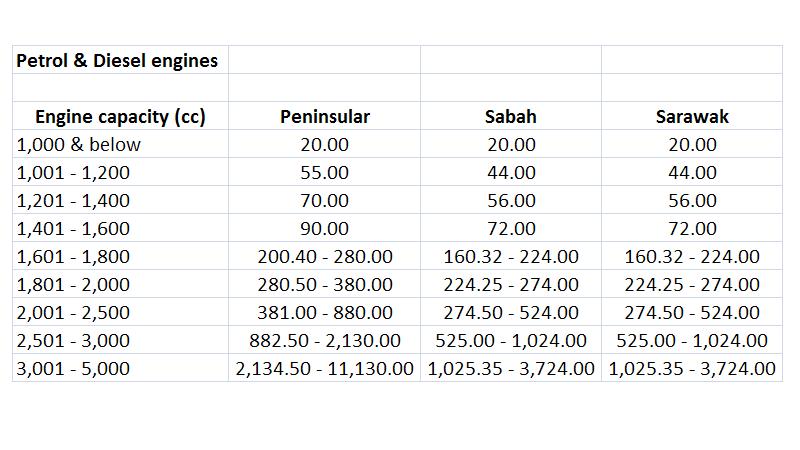

If so, please take a look at the road taxation amount tables:

So, a 3.5litre Nissan 350Z’s road tax would cost you an additional 3 months of your monthly repayment (assuming you took a 7 year full loan) …. and that’s not even counting the insurance amount which would probably cost you that iPhone 5 you’ve been so eagerly waiting.

So, a 3.5litre Nissan 350Z’s road tax would cost you an additional 3 months of your monthly repayment (assuming you took a 7 year full loan) …. and that’s not even counting the insurance amount which would probably cost you that iPhone 5 you’ve been so eagerly waiting.

Unless you’re a timber tycoon staying in the forests of Borneo, getting a Ninja King in Peninsular would probably cost you a Rolex watch … year after year while you hold on to the car …. which is a little strange because your car value continues to drop but you’d still be contributing a significant amount of your money to the government.

Hey, that’s fine if you’ve got the money. Someone’s got to pay for the police, fire brigade, public healthcare system and all other government amnesties. But if you can feel the pinch of the amounts listed above, do reconsider your decision and get a small cc, turbocharged car instead.

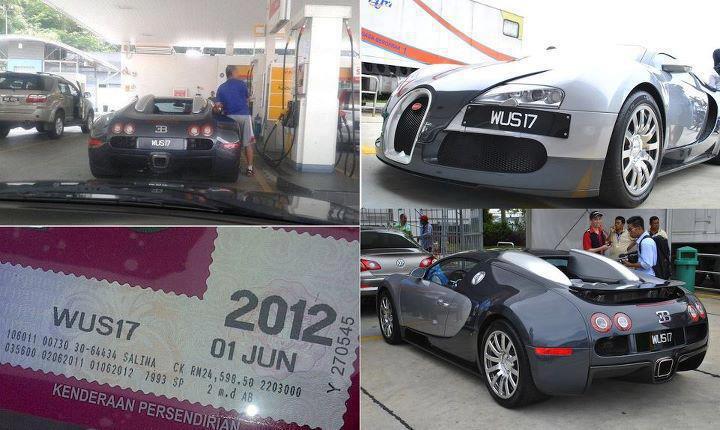

No, not this one:

More detailed information for road tax calculations can be found here (unfortunately, it’s in Bahasa Malaysia so you need to get a translator if you’re unfamiliar with the language):

6 Comments

Shouldn’t the road tax be the same for cars whether it is diesel or petrol?

I thought Ford Focus TDCi owners pay the same amount of road tax as petrol Focus owners?

Yup, according to AutoConnexion price list for TDCi and Ghia Focus, it is the same. You should clarify on the Diesel road tax. I think those apply to commercial vehicles only.

Hi AyamGolek,

Thanks for pointing this out. You are quite right …. the road tax rates for both petrol and diesel has been standardised to be the same. Sorry for the error

I guess the Gov is going to be in a dilemma pretty soon when it comes to NAP and structures for duty and taxation. The road tax principle here is like it was in the UK many moons ago, the bigger the CC the richer you are so the more road tax you pay. Add in fuel subsidies and ask who is benefiting most from subsidized fuel, the guy who earns RM1000 a month or the guy who earns RM20,000 a month and drives a Porsche or whatever. There will be a point in time where the Gov rehashes the present structure. As you know, in Europe, Road tax is based on emissions, there lies another issue, local builds emit more emissions than equivalent conti’s for example. One thing to note in Europe is that when emissions based duties became applicable, diesel prices went up and to this day, its still far more expensive per litre than petrol.Stealth taxation some call it, lower road duties but higher fuel duties.

Sorry for waffling on! As usual, good post Bro!

To continue with the “Go Green” concept, it would be wise to structure the roadtax pricing based on emission. It would also help keep older cars off the road and encourage purchase of newer cars which would help the automotive industry. This would benefit everybody.

Don’t forget that our govt will also benefit from taxes / duties from new car sales.

There are methods of circumventing high road taxes on large capacity vehicles – thanks to the different rates applied in Sabah and Sarawak 😀