A recent article by the Malaysian Insider about automotive sales of 2016 suggests that things are going to get worse for car manufacturers next year. Up to 10 months this year, the industry recorded 541,142 units which was 1% lower than a year ago. You may be thinking 1% isn’t too bad – just a couple of thousand short but remember that Malaysia is is a developing nation; what sales numbers we have, it is not optimum and should see continuous increase as we move towards a high-income status country. To record a decrease in sales numbers is alarming because the decline isn’t just that 1% – it is the drop from official estimates. The Malaysian Automotive Association (MAA) have reported 2014 Total Industry Volume to be 666,465 units and set a forecast of 670,000 units for 2015. It was fortunate that November figures saw an improvement and the 11-month TIV gap narrowed to -0.7% but it is likely we will not see much difference in this year’s TIV compared to the last.

Let’s face it; 2015 has not been a rosy year for many who are in business and this is not limited to the automotive sector. The introduction of the Goods and Services Tax in April, the weakening Ringgit, the increase in other expenses such as tolls and other general costs has a cumulative debilitating effect on consumer spending.

To some extent, having CKD operations here helps in minimizing the currency effect but it has gone to the extend that local component manufacturers that imports parts in USD are finding it hard to cope without jacking up prices and even Proton is considering to revise its prices upwards next year.

As if that wasn’t bad enough, the inflation would cause household debts to rise and this may see Bank Negara tightening loan applications which affects the number of potential new customers.

But, it’s not all doom and gloom

Mercedes Benz Malaysia have recently announced record breaking sales achievement, so much that Malaysia currently represents the biggest market for Mercedes-Benz passenger cars in Southeast Asia. Until October 2015, MBM have sold 9,146 units, an increase of 3,588 units compared to the same YTD period of last year. Spearheading this phenomenal growth is the C-class, E-Class and the S-class. The relatively more affordable CLA did contribute but its total sales numbers fell behind the traditional three models.

Mercedes’s success has affected the sale of other luxury marques such as BMW (2015 5,945 units vs 2014 6,348 units), and Audi (2015 1,227 units vs 2014 1,332 units) but the combined sales figure of these three brands shows an increase in demand for luxury brands at 16,318 units in 2015 vs 13,238 units in 2014.

In conclusion:-

Demand from higher income group for remains strong

A recent article from The Rakyat Post suggests that it will be a challenging 2016 for all the reasons highlighted above. What’s interesting to note in the article is the revelation that there has been an increase of demand in the four-wheel drive (4WD or 4×4) and sports utility vehicle (SUV) segment. An increase of 72.8% or 17,371 units, to be exact. While the exact reasons for such an increase warrants further market survey, we would guess that many consumers find

4×4 and SUVs to offer greater value and durability.

A third conclusion is observed based on analysis of Facebook boosts and confirmed by people in the industry.

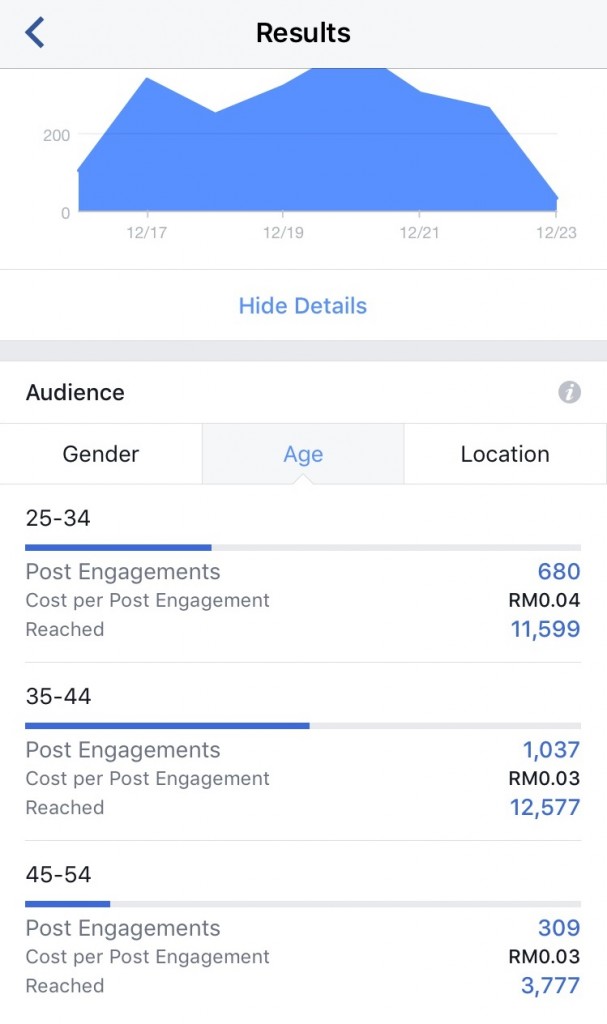

Above is the Facebook boost result for the 7-seater SUV shootout that concluded with 30,336 people reached (boost parameters set at RM66 over 7 days targeting Malaysians aged 25 and above). Naturally, the age group of 35-44 have the highest engagement but you’ll note that the younger 25-34 group numbers aren’t small. Considering that boosted posts were set not only for kensomuse readers but for everyone else, we are observing a trend where:

Car buyers are getting younger.

This occurrence has been more frequent and friends from principal companies have shared with us that potential customers who walk into their showrooms are of a younger age group. This changes the rules of the game as the decision making process of a new generation differs greatly compared to, say ten years ago. For instance, if you want to know more about a specific model in mind, your first reference is the internet. Gone are the days when you go hunting for info in a newsstand and over the years, various print publications (not just automotive) have reported drops in circulation.

The introduction of young car buyers has created opportunities for brands that previously struggled, in some cases, even dethroning the market leader. For instance, if someone told me 10 years ago that the Ford Ranger would be the selling in numbers that poses a threat to the Toyota Hilux, I’d like to try a bit of what he/she was smoking. The buyers are responsible for the rise of certain continental brands such as Volkswagen and Peugeot since 2009 and it has been encouraging enough for some brands such as Citroen and Renault to spend more in enhancing their distribution and service reach.

So there you have it; three trends that may make 2016 a year of great opportunity or grave adversity.

Read Part II: The Shift in Consumer Behavior see how GST and various other market forces affect the sales performance. It is no longer about who has the better offer.

No Comment